free shipping at $99

free shipping at $99

So, what's your jewelry really worth? It's a question that blends art and science, weighing its physical materials against things like craftsmanship and what's hot in the market right now. Think of it as uncovering the story and financial reality of your piece, all at once.

Figuring out what a piece of jewelry is worth might seem complicated, but it really boils down to a few key ideas. It’s not just about the weight of the gold or the sparkle of the stone; it's about understanding the different layers that build up to that final number.

Every single piece starts with an intrinsic value. This is its most basic, raw worth—the melt-down value of the gold, silver, or platinum, plus the wholesale cost of any gemstones. A simple 14K gold wedding band, for instance, has an intrinsic value tied directly to the day's gold price. This is the absolute rock-bottom price for your item.

But let's be real, jewelry is almost never sold just for its scrap value. That’s where market value comes in. This is the price a real person would be willing to pay for the piece as it is, which is where things like artistry, brand name, and current trends make all the difference.

When it comes to diamonds, the "Four Cs" are the universal language for quality. You'll hear these terms everywhere, so it's good to know what they mean:

These same basic ideas apply to other gemstones, too. A sapphire's value, for example, skyrockets with deep, rich color and high clarity, just like a diamond's. Getting a handle on these factors gives you the framework to judge the quality of the most valuable parts of your jewelry.

Here's the bottom line: Market value almost always blows past intrinsic value. A gorgeous vintage Art Deco ring is worth so much more than its gold and diamond content because its design, history, and the simple fact that people want that specific style give it a whole other level of value.

Knowing the difference between these types of value is the first major step. The intrinsic value gives you a baseline, a starting point. But the real story is told by the craftsmanship, the brand, its condition, and what buyers are looking for today. That's what truly sets the price.

The very first thing you need to look at—before you even think about the design, brand, or age—is what your jewelry is actually made of. The materials are the foundation of its value, and learning to spot the good stuff is how you’ll separate a genuinely valuable heirloom from a fun piece of costume jewelry.

Your best clue is usually a tiny stamp called a hallmark. Grab a magnifying glass and check the inside of the ring band, the clasp of a necklace, or the post of an earring. If you can’t find one, that can be a red flag; it often means you’re looking at fashion jewelry.

Think of these little stamps as a secret language that’s surprisingly easy to learn. They tell you exactly what metal you’re holding and how pure it is, which is the baseline for its intrinsic worth.

You'll see a few common markings over and over again:

These materials are the heavy hitters in a piece’s valuation. In 2023, for example, global gold demand soared past 4,440 metric tons, and jewelry was the biggest reason why. With gold holding about 54.9% of the market share by material, its daily price swings have a direct and immediate effect on your piece's value.

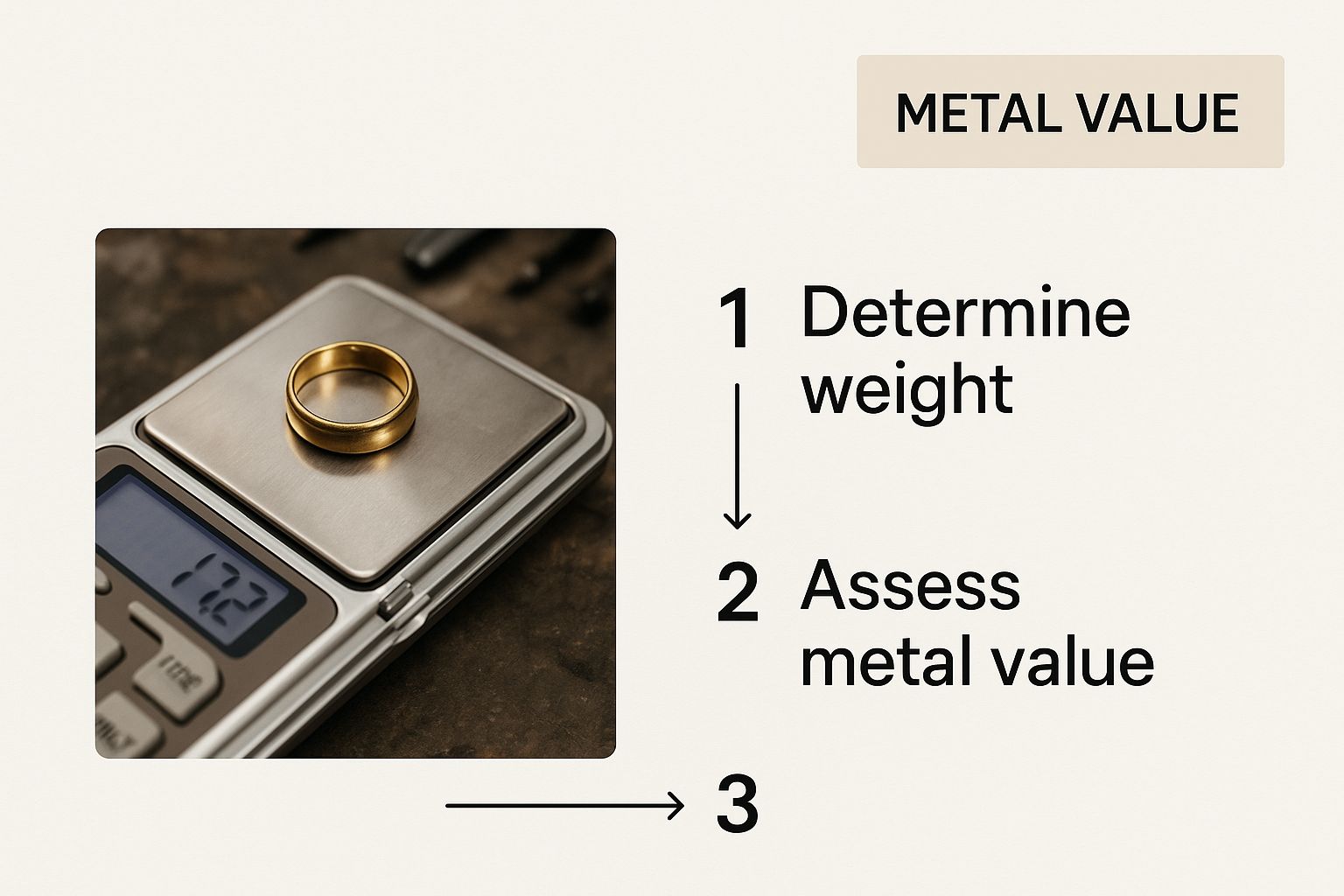

This is all about getting to the "melt value"—the core worth of the precious metal itself.

As you can see, it starts with the market price per gram, which you then multiply by your item's weight and purity. That gives you the fundamental value before any other factors like craftsmanship or brand come into play.

If the metal checks out, there’s a much better chance the stones are real, too. You’ll need a gemologist for a 100% certain verdict, but you can do a few simple tests at home to get a pretty good idea.

A great place to start is the breath test. Real diamonds are incredible heat conductors. Breathe on the stone like you’re fogging up a mirror. If the fog clears almost instantly, that's a good sign. If it stays foggy for more than a couple of seconds, you’re likely dealing with something like cubic zirconia or glass.

My Pro Tip: Get yourself a jeweler's loupe. It's a small magnifying glass and it will become your best friend. Use it to hunt for tiny natural flaws, or "inclusions," inside the stone. Man-made synthetics are often too perfect, but most natural gems have tiny imperfections that are like a birthmark proving their authenticity.

Another quick reality check is the setting. Jewelers don’t mount valuable gems in cheap metal. If your hallmark check revealed the setting is just gold-plated (look for stamps like "GF" or "HGP"), you can be almost certain the stone isn't a precious gem. These little observations all add up, giving you a strong case for your jewelry’s true composition.

Two pieces of jewelry can look almost identical, made from the same materials, but have wildly different values. What's the secret? It's a mix of craftsmanship, condition, and the story behind the piece—its provenance. Learning how to value jewelry means looking past the sparkle of the gold and gemstones to appreciate these more subtle, but critical, factors.

The difference almost always starts with craftsmanship. A high-quality, handmade piece has a soul and a level of detail that a mass-produced item just can't match. You have to look closely. Are the solder joints—where the metal pieces connect—clean and practically invisible? That’s the sign of a skilled artisan at work.

Next, look at how the gemstones are set. Secure prong settings that are uniform and evenly spaced are a classic mark of quality. Intricate details like delicate filigree (that lacy-looking metalwork) or milgrain (those tiny metal beads along an edge) should be crisp and precise. In contrast, a mass-produced ring might have sloppy solder work or flimsy, uneven prongs that just don't inspire confidence.

Now it's time to be a brutally honest judge. Every scratch, dent, or missing stone chips away at the final value. It makes sense, right? A piece that's in pristine condition will almost always be worth more than one that's clearly been through the wringer.

Here’s a quick checklist for your inspection:

A piece’s condition tells a story. While a bit of patina on an antique can actually be desirable, significant damage like a cracked stone or a broken clasp can slash its resale value by 20-50% or more, depending on how bad it is and what it would cost to fix.

Proper care is everything when it comes to maintaining value. For silver pieces, just keeping them clean is key to preventing tarnish that can hide beautiful details and damage the metal over time. If you need some pointers, our guide on how to clean sterling silver has safe and effective methods.

Finally, we get to provenance—the documented history and origin of the piece. This is where value can truly skyrocket. A simple gold pin might just be worth its weight in gold. But if that exact same pin was designed by Cartier and has the paperwork to prove it? Its value multiplies, sometimes many times over.

Look for a maker’s mark or logo stamped somewhere on the piece. Big names like Tiffany & Co., Van Cleef & Arpels, or Cartier always command a premium. But even lesser-known, respected artisans add significant value. If you find a mark, a quick online search can often tell you about the designer’s reputation and the era they worked in, adding another fascinating layer to your valuation.

Alright, you've figured out what your jewelry is made of and you have a good sense of its quality. Now comes the fun part: finding out what it's actually worth in today's market. This is where you connect the physical piece in your hand to what real people are willing to pay for it right now. The value of the gold or gemstones is just your starting point; the market always has the final say.

Think of it like playing detective and finding your jewelry's long-lost twin online. Your goal is to track down recently sold items that are as close a match to yours as possible. In the appraisal world, we call these "comparables," and it’s the single most effective way to get a realistic idea of what your piece might sell for.

Online auction sites and marketplaces are absolute goldmines for real-time sales data. A platform like eBay is a fantastic resource, but you have to know how to dig for the right information.

Here's a pro tip: the jewelry market is always changing. A style that was all the rage five years ago might have cooled off today, and vice versa. Your research needs to be current, so focus only on sales from the last few months to get an accurate picture.

To put this all into perspective, there are several ways to look at value, and each serves a different purpose.

| Valuation Type | Primary Purpose | Basis of Value | Common Use Case |

|---|---|---|---|

| Fair Market Value (FMV) | To determine a price for a sale between a willing buyer and seller. | Recent sales data of comparable items (what you're doing now). | Selling a pre-owned piece, estate settlements, charitable donations. |

| Retail Replacement Value | To determine the cost of replacing the item with a new, similar one. | The current retail price of a brand-new equivalent item from a store. | Insurance appraisals (to ensure you can replace it if lost or stolen). |

| Intrinsic or Melt Value | To determine the base value of the raw precious metals and gemstones. | The current spot price of the metals and the wholesale value of the gems. | Selling for scrap, quick liquidation, establishing a baseline value. |

Understanding these different approaches helps you know which "value" you're actually looking for. For selling a piece yourself, Fair Market Value is your North Star.

The way people shop for jewelry has completely shifted, and that directly impacts how we value it. The global online jewelry market was valued at an incredible $46.1 billion in 2024 and is expected to rocket to nearly $129 billion by 2032.

This e-commerce explosion has created a massive, publicly accessible database of pricing information that simply didn't exist before. To really tap into your jewelry's potential, learning how to price jewelry for maximum profit is a vital skill that uses this online data to your advantage.

Don't just stop at auction sites. Specialized online jewelry retailers and antique dealer websites offer another crucial layer of insight. Sure, their prices are retail (and usually higher than what you'd see on eBay), but they give you a valuable benchmark for what a piece is worth in a professional, curated environment. This research is what bridges the gap between raw material value and its real-world price tag, giving you a solid, realistic expectation of what your jewelry is truly worth.

While your own research gives you a fantastic starting point, there are definitely times when a DIY valuation just won’t cut it. When you’re dealing with insurance, legal matters, or making big financial decisions, you need to call in a certified professional. This is how you get a legally recognized value for your piece and protect your investment.

Think of it as moving from an educated guess to official, ironclad documentation.

A professional appraisal hands you an authoritative report that insurance companies and courts will actually accept. It’s a small investment that offers serious financial protection and, just as importantly, peace of mind for your most precious items.

Here’s something a lot of people don’t realize: not all appraisals are the same. The reason for the valuation completely changes the final number, so it's super important to know what you’re asking for.

Retail Replacement Value: This is the big one, and it's what you need for insurance. An appraiser figures out what it would cost to buy a brand-new, identical piece from a retail store today. This number is always going to seem high because it has to cover the cost of materials, labor, and the jeweler's markup. The goal is to make sure you have enough money to replace the item if it’s lost or stolen.

Fair Market Value (FMV): This is the "real world" price. It’s what a willing buyer would realistically pay a willing seller for the item in its current, used condition. You’ll see this value used for estate settlements, divorce proceedings, or sometimes for charitable donations. FMV is almost always significantly lower than the retail replacement value.

Understanding this difference is everything. An insurance appraisal that says your ring is worth $10,000 doesn't mean you can sell it for that much. Its fair market value might be closer to $3,000–$4,000.

When you’re ready for an official valuation, finding the right expert is key. Don’t just wander into the nearest jewelry store. You want someone with credentials that prove they know their stuff and follow strict ethical standards.

A great place to start is looking for a Graduate Gemologist (G.G.) diploma from the Gemological Institute of America (GIA)—that’s the gold standard in the industry. For even more confidence, look for appraisers connected with groups like the American Society of Appraisers (ASA) or the National Association of Jewelry Appraisers (NAJA). You can learn more about tracking down a trusted expert in our guide to jewelry appraisal services near you.

A qualified appraiser doesn't just look at your ring; they see it within the context of a massive global luxury jewelry market, which is expected to grow from $57.13 billion in 2025 to nearly $109.2 billion by 2032. Their expertise helps place your individual item within those powerful market trends. A truly professional report will include photographs, precise measurements, and a full, detailed description of your piece, giving you the official documentation you need for any situation.

One of the biggest points of confusion is the huge gap between an appraisal value and what someone will actually pay you in cash. It's a question I hear all the time.

An insurance appraisal gives you the retail replacement value—that's the high-end number representing what it would cost to buy a brand new, similar item from a store today. A cash offer, on the other hand, is all about the lower fair market value, which is what a real buyer is willing to pay for it as a secondhand piece.

The big takeaway? An insurance appraisal is for your protection, not for resale. Don't be surprised if a cash offer is only 20-40% of that appraised value. That's completely normal in the jewelry business.

Another tricky area is inherited jewelry. The sentimental attachment can be incredibly powerful, making it tough to look at the piece objectively. My best advice is to try and separate the emotion from the financial assessment. Get a professional opinion on its market value first; this gives you a clear-headed starting point for whatever you decide to do next.

People often ask me if it's even worth the cost to appraise smaller diamonds, like the ones you see in a pavé setting. Generally, my answer is no. If the total carat weight is low and the individual stones are tiny, getting a formal grading report for each one just isn't cost-effective. An appraiser will usually assess them as a group and give a value for the total weight.

And finally, how often should you get your jewelry appraised for insurance? A good rule of thumb is every three to five years. The prices of precious metals and gemstones are always changing. An outdated appraisal could leave you seriously underinsured if you ever need to file a claim.

If you’re looking for more specific guidance, you might find our article on how to know what your ring is worth really helpful. Answering these common questions clears up that lingering confusion and puts you on much stronger footing as you assess your collection.

Discover your own hidden treasures with Jackpot Candles! Each of our beautifully scented, all-natural soy candles and bath bombs contains a surprise piece of jewelry. You could reveal a piece worth up to $5,000! Start your surprise reveal adventure today at https://www.jackpotcandles.com.

Comments will be approved before showing up.